Quick Navigation

- Background: Why Senegal is a key market

- SENELEC (Utility-Led Programs)

- AGEROUTE + Municipal Councils

- Solektra / Akon Lighting Africa (Senegal)

- Eiffage Énergie Systèmes (Senegal)

- VINCI Energies (Senegal Unit)

- CSE – Compagnie Sahélienne d’Entreprise

- Chinois EPCs (Sinohydro, CRBC, CWE) in Senegal

- Local EPCs & SMEs (Dakar, Thiès, Saint-Louis)

- NGO & Donor Projects (AFD, World Bank, EU)

- Port, SEZ & Industrial Park Integrators

- Comparison of Key Players

- Final Takeaway

- Work With Sunlurio

Background: Why Senegal is a key market

Senegal is a Francophone tender market. Documents come in French. Councils and ministries lean on AFD/Proparco style standards. Dakar’s port and the new expressways need safe, lit corridors. Rural towns want lights around markets and clinics.

If you’re bidding, expect requests for IEC/CE, IP66/IK08, LM-80/LM-79, and pole coatings to ISO 12944 (coastal air around Dakar is rough on steel). Price matters, but paperwork and delivery matter more. No paperwork, no award.

SENELEC (Utility-Led Programs)

SENELEC is the national utility. While their core is grid, they support solar street lighting in urban upgrades and power-saving programs. They coordinate with communes and ministries.

What they actually do: Frame specs, endorse corridors, and co-manage procurement with councils. They’ll ask for photometry files (IES), autonomy proof, and spares lists.

Buyer view: When SENELEC signs off, approvals move faster. Good for EPCs who want fewer surprises during review.

Example scope: Utility-backed packages in Dakar suburbs with several hundred LEDs and solar kits over multiple phases. Focus on main feeders and bus lanes.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Government weight and process | Bureaucratic steps, formal reviews |

| Clear technical baselines | Timelines can stretch |

| Visibility for contractors | Scope shifts with budget releases |

AGEROUTE manages national roads; councils own local streets and parks. Many solar street light jobs sit here: fast visibility wins for mayors and MPs.

What they actually do: Road corridor lighting, roundabouts, and market streets. Coastal communes ask for stronger anti-corrosion.

Buyer view: Smaller lots, quicker procurement, price-sensitive. The right partner is one that can deliver clean files in French and install quickly.

Example scope: Thiès and Saint-Louis council packages with 50–150 solar units per lot, hot-dip galvanized poles, basic dimming profiles.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Local decisions can be fast | Budgets are tight |

| Good for mid-size EPCs | Paperwork quality varies by council |

| Visible impact | Lots split across phases |

Solektra / Akon Lighting Africa (Senegal)

Akon’s team helped kickstart solar lighting across Francophone West Africa. In Senegal, they’ve run community-scale rollouts with simple all-in-one units.

What they actually do: Integrated lights (panel + battery + LED), community engagement, quick installs. Suits villages, markets, feeder roads.

Buyer view: Speed and community acceptance. Good for donor pilots and town centers. Not the most advanced optics, but installs are fast.

Example scope: Multi-commune batches around Dakar region and inland towns; crews trained to swap heads quickly if needed.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Fast deployment, community-friendly | Lower lm/W vs premium |

| Proven in Francophone tenders | Limited high-speed road optics |

| Local know-how | Shorter warranties on some kits |

Eiffage Énergie Systèmes (Senegal)

French group with a strong Senegal presence. Good choice for structured municipal and PPP jobs, where files must pass strict technical checks.

What they actually do: Design, supply, and install lighting with compliant photometry, cabinets (if not all-in-one), and AFD-grade documentation.

Buyer view: You pay more, but the submittal quality saves weeks of back-and-forth. Helpful on port-adjacent roads needing anti-corrosion coatings.

Example scope: Urban arterials in Dakar metro, combining solar LEDs with traffic nodes and smart controls in select zones.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Excellent documentation in French | Higher capex |

| Strong urban references | Lead times for specials |

| PPP experience | Less flexible on spec swaps |

VINCI Energies (Senegal Unit)

Another major French player. Similar to Eiffage on process and quality. Often tied to transport and urban development packages.

What they actually do: Full street lighting systems, control gear, and integration with ITS when required.

Buyer view: Good for donor or ministry-level projects. They know the audit trail donors expect.

Example scope: City avenues and bus corridors in Dakar/Guédiawaye, staged over multiple tranches.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Strong tender compliance | Premium price tier |

| ITS/controls integration | Less suited to tiny lots |

| Donor-savvy reporting | Longer procurement chain |

CSE – Compagnie Sahélienne d’Entreprise

Big local civil contractor. When roads or bridges get built, CSE often manages the lighting line item with partners.

What they actually do: Poles, foundations, mast arms, coordination with a lighting OEM. Smooth on civils and HSE.

Buyer view: If your job is road-heavy, CSE simplifies site work and keeps pace with pavement schedules.

Example scope: National road upgrades near Mbour and Saly with solar lighting at junctions and crossings.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Strong on civils and HSE | Lighting spec often partner-driven |

| Schedule discipline | Not the cheapest |

| Wide Senegal footprint | Documentation varies with suppliers |

---

Chinois EPCs (Sinohydro, CRBC, CWE) in Senegal

Chinese contractors deliver major road and port connectors. Solar lighting rides along as part of the corridor package.

What they actually do: High-volume installs with modular or integrated systems, cabinets when needed, and Chinese finance leverage.

Buyer view: Scale and speed on big jobs. Less flexible on brand swaps mid-tender. You must lock specs early.

Example scope: Dakar–Diamniadio axis segments with mixed grid/solar lighting, depending on section constraints.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Scale + financing options | Rigid change control |

| Corridor delivery at pace | Local SME partners sidelined |

| Works for PPP roads | Paperwork style not always donor-perfect |

Local EPCs & SMEs (Dakar, Thiès, Saint-Louis)

Dozens of local firms import all-in-one lights and pair them with local poles. Perfect for 50–150 unit council lots and park paths.

What they actually do: Import heads, fabricate or source poles, install fast. French docs are simple but acceptable for small lots.

Buyer view: Lowest capex, quick wins before budget cut-off. Plan for spares and a clear warranty path.

Example scope: Ward-level upgrades in Thiès, Saint-Louis, and Kaolack with standard 6–8 m poles and dusk-to-dawn profiles.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Cheapest per unit | QC varies by batch |

| Very fast delivery | Limited optics options |

| Easy to engage | Shorter warranties |

NGO & Donor Projects (AFD, World Bank, EU)

Donor-funded lots demand paperwork discipline. Specs are fixed; autonomy and corrosion tests must match the book.

What they actually do: Fund lighting for rural towns, clinics, schools, and market streets. Vendors are picked for compliance first, then price.

Buyer view: Secure payments, slow admin. Choose a supplier who can hand over French-language test reports without drama.

Example scope: Market-street lighting in Casamance towns, phased over two budget years.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Financing secured | Long paperwork cycles |

| Clear specs, fewer disputes | Less room to alternate brands |

| Good visibility | Heavy reporting load |

Port, SEZ & Industrial Park Integrators

Dakar’s port roads and new SEZ/industrial parks need reliable lighting for safety and investor audits. Integrators bundle security, CCTV, and lighting.

What they actually do: Mix solar street lights with CCTV on poles, sometimes Wi-Fi hotspots for port yards.

Buyer view: Higher standards, more corrosion protection, and anti-theft brackets. Price is judged against downtime risk.

Example scope: Port-adjacent arterials near Dakar Port and access ways to logistics parks.

Advantages vs Limitations

| Advantages | Limitations |

|---|---|

| Security-driven specs | Higher capex |

| Better O&M planning | Requires skilled installers |

| Strong stakeholder value | Longer approvals with port authority |

| Player | Strength | Typical Use | Example Context |

|---|---|---|---|

| SENELEC | Utility coordination | City corridors | Dakar suburbs, phased |

| AGEROUTE + Councils | Fast local impact | Feeder/market roads | 50–150 unit lots |

| Solektra/Akon | Rapid AIO rollout | Town centers, villages | Multi-commune batches |

| Eiffage Énergie | Donor-grade files | Urban avenues, PPP | Coastal arterials |

| VINCI Energies | ITS/controls + quality | Bus corridors | Staged city tranches |

| CSE | Civils + HSE | Highway nodes | Junction lighting |

| Chinese EPCs | Scale + finance | Expressways | Port connectors |

| Local SMEs | Lowest capex | Ward projects | 6–8 m poles |

| Donor Programs | Secure finance | Rural towns | Clinics/markets |

| Port/SEZ Integrators | Security focus | Ports/logistics | CCTV + lighting |

Senegal buys with French paperwork logic. The winners bring:

1) Clean French documentation (IEC/CE, LM-80/LM-79, IP66/IK08).

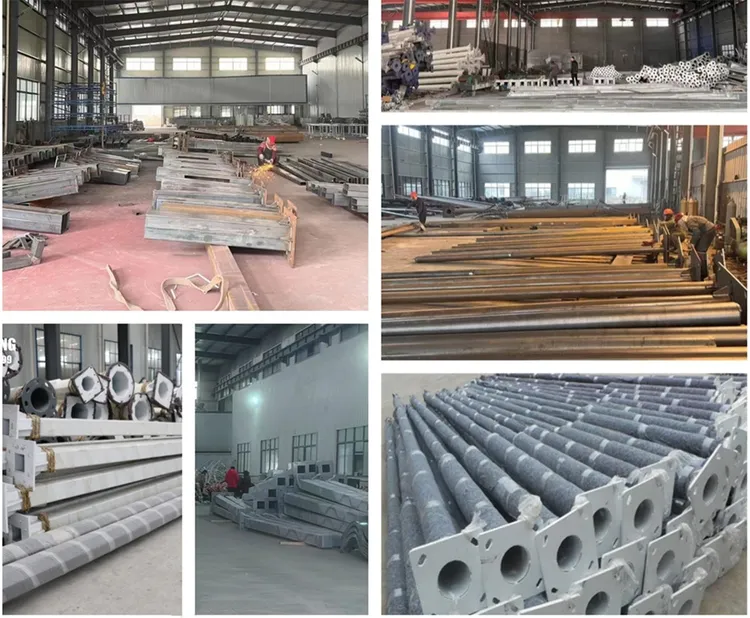

2) Poles that survive the coast (hot-dip galvanized, ISO 12944).

3) Honest autonomy (≥3 nights) instead of fantasy wattage.

- Need donor-ready files → Eiffage, VINCI are safe, but pricey.

- Need fast town rollouts → Solektra/Akon or local SMEs do the job.

- Need big corridor delivery → Chinese EPCs and CSE keep schedule.

- Utility coordination helps → SENELEC sign-off makes life easier.

If you want 230 lm/W LEDs, 6000+ cycle LiFePO₄, and coastal-proof poles with French-language test reports that pass AFD-style checks on the first round—bring Sunlurio into your bid.

What we give EPCs and councils in Senegal:

- French-language, compliance-ready submittals: IEC/CE, LM-80/LM-79, IP66/IK08, ISO 12944 pole tests

- High-efficiency systems: 230 lm/W, ≥12 h/night, ≥3 nights autonomy

- LiFePO₄ batteries: 6000+ cycles, secure wiring and anti-theft hardware

- Coastal coatings: hot-dip galvanizing + duplex options for C4/C5 environments

- Container logistics + spares lists tailored to lot phasing

👉 Don’t let French paperwork or coastal corrosion sink your tender. Win cleanly with Sunlurio.