Africa is moving faster into solar street lighting than any other continent. Governments, EPCs, and NGOs want visible, fast, and affordable results: safe roads, lower OPEX, and less blackout risk. In 2025, ten countries stand out — both for tender activity and real on-the-ground projects. This report brings them together, with buyer-focused analysis of the top companies, utilities, and EPCs you will face.

Click on a country below to jump directly to its market analysis.

Navigation Menu

- Nigeria

- Ghana

- Kenya

- Tanzania

- Uganda

- Ethiopia

- South Africa

- Zambia

- Senegal

- Burkina Faso

- Regional Summary

- Work With Sunlurio

Nigeria – Top 10 Solar Street Light Companies in Nigeria

Market Background

Nigeria is Africa’s largest solar lighting market. Lagos, Abuja, Port Harcourt, and Kano all suffer from grid instability and high diesel costs. Ministries and state governments push for solar street lights under urban renewal and rural safety programs. EPC contractors face challenges with customs clearance, vandalism, and tender compliance. The opportunity is big, but only suppliers with reliable specs and paperwork win tenders.

Top 10 Companies in Nigeria

-

Solad Power Group

One of the strongest private power players, Solad develops distributed energy and lighting. Their solar street light projects cover Lagos suburbs and industrial parks. EPCs like them because they bring financing and credible after-sales, though their focus is broader than lighting alone. -

Lumos Nigeria

Known for solar home systems but also pushing solar street lighting. Their advantage is customer financing models and wide distribution. Good for councils who want visible but smaller rollouts. Weakness: limited in heavy pole engineering. -

Arnergy Solar

Focus on commercial and industrial solar but took on several urban lighting projects. They are credible with investors, good at hybrid systems, and compliance-savvy. Limitation: premium pricing compared to local SMEs. -

Creeds Energy

Local renewable EPC with track record in donor-funded jobs. They supplied solar street lights in Kaduna and Niger states. EPCs like their quick response and good paperwork. Limitation: smaller capacity for large-scale rollouts. -

Blue Camel Energy

Abuja-based renewable firm. They supplied solar lights for government campuses and urban roads. Buyers value their training programs for local crews. Limitation: less competitive pricing. -

Rubitec Solar

Well-known renewable EPC with focus on donor/NGO projects. Installed solar street lights in rural northern Nigeria. Strong compliance culture. Limitation: not geared for mass container imports. -

Prostar Global Energy

Active in Niger Delta states. They do solar street lights for oil-host communities. Strength: good at community engagement. Limitation: OPEX models are not standardized. -

Starsight Energy

Better known for C&I solar and efficiency but capable of delivering street lighting as part of estates. EPCs trust their financial backing. Limitation: more corporate focus, not grassroots. -

Government Agencies (Rural Electrification Agency, State Ministries)

Not a company, but decisive buyers. REA-led projects bring donor funds and clear tender rules. Limitation: paperwork and politics slow timelines. -

Chinese EPC Channels (Sinohydro, CWE, AVIC in Nigeria)

Big Chinese EPCs deliver highways and corridors, bundling in solar street lights. They bring scale, but local SMEs often sidelined.

Comparison Table – Nigeria

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| Solad Power Group | Financing + scale | Lighting not sole focus | Industrial parks |

| Lumos | Distribution + financing | Weak in pole work | Councils, suburbs |

| Arnergy | Hybrid + compliance | Premium pricing | C&I + cities |

| Creeds Energy | Donor compliance | Smaller capacity | Rural programs |

| Blue Camel | Training + support | Higher capex | Govt campuses |

| Rubitec Solar | NGO/donor projects | Limited scale | Northern Nigeria |

| Prostar | Community focus | OPEX models weak | Delta villages |

| Starsight | Finance-backed | Corporate focus | Estates, campuses |

| REA/Ministries | Donor finance | Politics, slow | Rural lots |

| Chinese EPCs | Scale + roads | Local SMEs sidelined | Highways |

Ghana – Top 10 Solar Street Light Companies in Ghana

Market Background

Ghana has a national electrification plan, but rural and peri-urban areas remain underlit. Government pushes through the “National Electrification Scheme” and Ministry of Energy. Donor financing (World Bank, AfDB) supports rural street lighting. Procurement is in Accra, Kumasi, and northern regions. EPCs must deliver systems that handle humidity and heavy rains.

Top 10 Companies in Ghana

-

Strategic Power Solutions (SPS)

Local firm producing PV modules, also supplying solar street lights. Strong donor ties. -

Wilkins Engineering

Engineering EPC with experience in mini-grids and street lighting. Good compliance files. -

BXC Ghana (Chinese JV)

Hybrid power and street lighting, strong scale. -

Dutch & Co Ltd

Accra-based EPC with visible lighting projects. Trusted by councils. -

Plan International / NGO partners

Small but steady lots, especially in northern schools. -

Volta River Authority (VRA) Projects

Utility-backed tenders include corridor lighting. -

China Jiangxi International

Chinese EPC tied to roads, bundling lights. -

Solar Light Company Ghana

Retail + EPC, visible in peri-urban Accra. -

Ministry of Energy (Government)

Drives donor-funded projects. -

Azuri Technologies

Home solar company occasionally delivering community lighting.

Comparison Table – Ghana

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| SPS | Local PV + donor ties | Scale limited | Schools, clinics |

| Wilkins Eng. | Strong EPC | Higher price | Rural mini-grids |

| BXC Ghana | Scale | China-JV focus | City corridors |

| Dutch & Co | Council trusted | Mid-size only | Markets |

| NGOs | Grassroots | Small scale | Northern villages |

| VRA | Utility power | Bureaucratic | Corridors |

| Jiangxi Intl | Road + lights | Rigid | Highways |

| Solar Light Co | Retail + EPC | Entry-level specs | Suburbs |

| Ministry Energy | Donor coordination | Slow admin | National |

| Azuri | Pay-go reach | Not lighting focus | Community pilots |

Kenya – Top 10 Solar Street Light Companies in Kenya

Market Background

Kenya is East Africa’s solar hub. Nairobi’s Smart City plan includes solar street lighting. Counties procure through tenders with donor or PPP support. Rural roads and highways are funded by World Bank and AfDB. EPCs face vandalism risks and strict KEBS standards.

Top 10 Companies in Kenya

-

Kenya Power & Lighting Company (KPLC)

Utility coordinating urban lighting programs. -

Rural Electrification and Renewable Energy Corporation (REREC)

Pushes rural lighting with donor backing. -

Strauss Energy

Local innovator with solar integration, including lighting. -

Davis & Shirtliff

Distributor with presence in water + solar, offering lights. -

Chloride Exide Kenya

Known for batteries, also supplies street lights. -

Sollatek East Africa

Distributor and integrator with wide East Africa presence. -

Sunking (Greenlight Planet)

Pay-go leader, also delivering donor-funded lights. -

Chinese EPCs (Sinohydro, AVIC, CWE)

Deliver road projects with bundled solar lighting. -

Local EPCs (Nairobi, Mombasa)

SMEs bidding county lots, 50–100 lights. -

UNDP / NGO-backed pilots

Rural schools and clinics, donor projects.

Comparison Table – Kenya

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| KPLC | Utility authority | Bureaucratic | Nairobi projects |

| REREC | Donor rural | Slow processes | Villages |

| Strauss | Local innovation | Limited scale | Estates |

| Davis & Shirtliff | Strong distribution | Higher margin | Counties |

| Chloride Exide | Battery expertise | Mid-level lights | Off-grid |

| Sollatek EA | Regional presence | Specs mid | Councils |

| Sunking | Donor trusted | Not heavy road | Rural |

| Chinese EPCs | Scale | Rigid | Highways |

| Local SMEs | Price | QC variable | Small lots |

| UNDP/NGOs | Secure pay | Tiny lots | Schools |

Tanzania – Top 10 Solar Street Light Companies in Tanzania

Market Background

Tanzania’s World Bank-supported energy loan program drives rural lighting. Municipalities in Dar es Salaam and Dodoma push solar for safety. Rural roads need lighting but budgets are tight. Donors fill the gap. EPCs must manage customs, logistics, and standards (TBS).

Top 10 Companies in Tanzania

-

Tanzania Electric Supply Company (TANESCO)

Utility handling big procurements. -

Rural Energy Agency (REA Tanzania)

Key driver of donor-funded rural programs. -

Mobisol / ENGIE Energy Access

Pay-go + donor projects. -

Rex Energy Tanzania

Local EPC active in councils. -

Ensol Tanzania Ltd

Renewable EPC with experience in lighting. -

Sollatek Tanzania

Distributor with donor programs. -

Chinese EPCs (Sinohydro, CWE)

Road-linked lighting. -

Local SMEs (Dar, Arusha)

Small council bids. -

World Bank / AfDB projects

Funded rural programs. -

NGOs (SNV, UNDP)

School + clinic lighting.

Comparison Table – Tanzania

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| TANESCO | Utility | Bureaucratic | City lots |

| REA Tanzania | Donor rural | Heavy admin | Villages |

| Mobisol/ENGIE | Donor trusted | Entry-level | Rural |

| Rex Energy | Local EPC | Small scale | Councils |

| Ensol | EPC depth | Mid-range | Institutions |

| Sollatek TZ | Supply chain | Specs mid | Towns |

| Chinese EPCs | Scale | Rigid | Highways |

| Local SMEs | Price | QC issues | Small wards |

| World Bank | Funding secure | Slow | Rural |

| NGOs | Community | Tiny lots | Schools |

Uganda – Top 10 Solar Street Light Companies in Uganda

Market Background

Uganda has low electrification and high donor involvement. Kampala councils push solar for safety. NGOs and UNDP fund rural lighting. EPCs must meet UNBS standards and handle customs delays.

Top 10 Companies in Uganda

-

Uganda Electricity Distribution Company Limited (UEDCL)

Utility-driven lighting programs. -

Rural Electrification Agency (Uganda)

Donor-backed rural lighting. -

SolarNow Uganda

Local EPC delivering donor-funded street lights. -

Fenix International (ENGIE Energy Access)

Pay-go plus donor pilots. -

d.light Uganda

Donor-trusted for rural lighting. -

M-KOPA Uganda

Pay-go firm expanding to lighting. -

Kirchner Solar Uganda

Local EPC with project record. -

Chinese EPCs (Sinohydro, CWE)

Bundled in road projects. -

NGO projects (UNDP, GIZ)

Lighting for schools and markets. -

Kampala Capital City Authority (KCCA)

City-level procurements.

Comparison Table – Uganda

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| UEDCL | Utility | Bureaucratic | Kampala |

| REA Uganda | Donor rural | Heavy admin | Villages |

| SolarNow | Local EPC | Mid-size | Schools |

| Fenix ENGIE | Donor trusted | Entry-level | Rural |

| d.light | NGO trust | Not heavy road | Villages |

| M-KOPA | Pay-go | Lighting side | Clinics |

| Kirchner Solar | Local EPC | Smaller scale | Councils |

| Chinese EPCs | Scale | Rigid | Roads |

| NGOs | Donor funded | Tiny lots | Schools |

| KCCA | City budget | Politics | Kampala wards |

Ethiopia – Top 10 Solar Street Light Companies in Ethiopia

Market Background

Ethiopia has weak grid coverage and frequent blackouts. Rural electrification is below 45%. Industrial parks in Hawassa and Dire Dawa need solar street lighting for safety. Donors (World Bank, AfDB) support EEP and EEU projects. EPCs face strict paperwork and logistics challenges.

Top 10 Companies in Ethiopia

-

Ethiopian Electric Power (EEP)

Utility managing large donor-backed projects. -

Ethiopian Electric Utility (EEU)

Handles city/suburban lighting tenders. -

Solar Development PLC

Local EPC, fast response, mid-size capacity. -

d.light / Fenix / Gogla members

Donor-trusted, community lighting. -

Ethiopian Engineering Group (EEG)

Local EPC, responsive, smaller projects. -

Chinese EPCs (Sinohydro, CWE, AVIC)

Highway lighting with Chinese finance. -

METEC (Defense Industry EPC)

Government-backed, industrial lighting. -

Addis Solar Tech / Rensys

Local SMEs, schools and clinics. -

World Bank/UNDP projects

Donor funded, paperwork heavy. -

Industrial parks & estates

Private demand for security lighting.

Comparison Table – Ethiopia

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| EEP | Largest buyer | Paperwork strict | Rural lots |

| EEU | Urban | Delays | Suburbs |

| Solar Dev. PLC | Local EPC | Mid-range specs | Industry |

| d.light/Fenix | Donor trust | Basic systems | Rural |

| EEG | Responsive | Small scale | Councils |

| Chinese EPCs | Scale | Bureaucratic | Highways |

| METEC | State-backed | Delays | Industrial |

| SMEs | Affordable | Low compliance | Schools |

| Donor projects | Funding secure | Slow | Rural |

| Industrial parks | Reliable | Small orders | Estates |

South Africa – Top 10 Solar Street Light Companies in South Africa

Market Background

South Africa’s Eskom crisis drives solar street lighting. Municipalities need lights that work through load-shedding. Procurement emphasizes SANS/IEC paperwork and local content. Buyers want price, but they also need systems that survive coastal corrosion and vandalism.

Top 10 Companies in South Africa

-

BEKA Schréder

Strong municipal compliance, premium quality. -

Betta Lights

Specialist in integrated AIO, fast installs. -

Genlux Lighting

Local manufacturing, quick pole tweaks. -

LED Lighting SA

Custom designs, aesthetics, coastal coatings. -

Rubicon South Africa

Distributor with one-stop sourcing. -

Sinetech

Importer of affordable AIO, wide stock. -

Leadsun South Africa

Smart AIO, better optics, higher price. -

Eurolux Projects Division

Volume supply, estates and councils. -

Chinese OEM via EPCs

Lowest capex, variable quality. -

Municipal buyers (councils)

Procurement-driven projects.

Comparison Table – South Africa

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| BEKA Schréder | Compliance | Higher cost | Arterials |

| Betta Lights | Fast install | Lower lm/W | Townships |

| Genlux | Local manuf. | EPC adds solar | Councils |

| LED Lighting SA | Custom | Premium | Waterfront |

| Rubicon SA | One-stop | Not OEM | Large BoMs |

| Sinetech | Cheap AIO | QC variable | Small towns |

| Leadsun SA | Smart optics | Price | Collector roads |

| Eurolux | Supply | Narrow range | Estates |

| Chinese OEM | Lowest price | Shorter life | Ward lots |

| Councils | Local buy | Political risk | Town centers |

Zambia – Top 10 Solar Street Light Companies in Zambia

Market Background

Zambia’s Ministry of Energy and REA drive rural lighting. Urban demand in Lusaka and Copperbelt corridors is growing. Donors fund many programs. EPCs must meet IEC/CE standards and ensure vandal-resistant poles.

Top 10 Companies in Zambia

-

REA Zambia

Rural electrification authority, major buyer. -

ZESCO

Utility coordinating urban programs. -

RDA + City Councils

Corridors, feeder roads. -

Copperbelt Energy Corporation (CEC)

Industrial corridor lighting. -

Sollatek Zambia

Distributor with wide reach. -

ENGIE Energy Access (Fenix)

Donor trusted, community lighting. -

VITALITE Zambia

Pay-go brand, rural presence. -

Muhanya Solar

Local EPC with engineering focus. -

Chinese EPCs

Scale projects, road contracts. -

Local SMEs

Import AIO, quick installs.

Comparison Table – Zambia

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| REA | Largest buyer | Heavy admin | Rural |

| ZESCO | Government weight | Bureaucracy | City |

| RDA + Councils | Fast local | Budget tight | Feeder |

| CEC | Industrial grade | Limited scope | Corridors |

| Sollatek | Supply chain | Mid specs | Councils |

| ENGIE | Donor trust | Basic | Villages |

| VITALITE | Rural network | Entry-level | Schools |

| Muhanya | Engineering | Higher capex | Urban |

| Chinese EPCs | Scale | Rigid | Highways |

| SMEs | Cheap | QC weak | Wards |

Senegal – Top 10 Solar Street Light Companies in Senegal

Market Background

Senegal runs donor-backed programs with AFD, Proparco, and EU. Dakar’s port corridors and new expressways need lighting. Councils procure smaller lots. Specs must include IEC/CE, IP66/IK08, and ISO 12944 for corrosion. Paperwork must be in French.

Top 10 Companies in Senegal

-

SENELEC

Utility, coordinates with communes. -

AGEROUTE + Municipal Councils

Corridor and feeder roads. -

Solektra / Akon Lighting Africa

Fast rollout with AIO. -

Eiffage Énergie Systèmes

Donor-grade files, urban roads. -

VINCI Energies Senegal

PPP and donor-heavy projects. -

CSE – Compagnie Sahélienne d’Entreprise

Civil works, roads + lighting. -

Chinese EPCs

Corridors with bundled lights. -

Local SMEs

Cheap AIO with local poles. -

Donor programs (AFD, EU, World Bank)

Fund rural lighting. -

Port & SEZ Integrators

Lighting + CCTV combos.

Comparison Table – Senegal

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| SENELEC | Gov weight | Admin | City corridors |

| AGEROUTE | Fast | Budget small | Feeder |

| Solektra | Fast rollout | Lower lm/W | Towns |

| Eiffage | Donor docs | Premium | Arterials |

| VINCI | PPP expertise | Expensive | Bus corridors |

| CSE | Civils + HSE | Lighting via partners | Roads |

| Chinese EPCs | Scale | Rigid | Highways |

| SMEs | Lowest cost | QC weak | Wards |

| Donors | Funding | Slow | Rural |

| Port Integrators | Security | Higher cost | SEZ |

Burkina Faso – Top 10 Solar Street Light Companies in Burkina Faso

Market Background

Burkina Faso has electrification below 20% in rural areas. Donors (World Bank, AfDB, BOAD, EU) drive most lighting programs. Tenders require IEC/CE, IP66/IK08, ISO 12944 poles, and French documents. Security is an issue, so visibility projects are important.

Top 10 Companies in Burkina Faso

-

Ministère de l’Énergie, des Mines et des Carrières (MEMC)

High-level tenders, donor funds. -

FDE – Fonds de Développement de l’Électrification

Rural electrification projects. -

SONABEL

Utility coordinating city upgrades. -

KYA-Energy Group (Togo)

Donor-compliant EPC, active in Burkina. -

Solektra / Akon Lighting Africa

Fast installs, community rollouts. -

Chinese EPCs (Sinohydro, CWE, CRBC)

Corridor + highway bundles. -

Local EPCs (Ouaga, Bobo-Dioulasso)

Small–medium council projects. -

Donor Programs (World Bank, BOAD)

Funding with strict paperwork. -

NGOs (UNDP, Plan International)

Community lots for schools/clinics. -

Sunlurio – Flagship 500-Set Project

Delivered 500 solar lights in 2024 with 7 m poles, 60 W 230 lm/W LEDs, LiFePO₄ 6000+ cycles, hot-dip galvanized poles, IEC/CE docs in French. Smooth customs, high impact in provincial towns.

Comparison Table – Burkina Faso

| Company | Advantage | Limitation | Typical Application |

|---|---|---|---|

| MEMC | Donor tenders | Admin heavy | Multi-province |

| FDE | Rural lots | Small scale | Markets |

| SONABEL | Utility | Bureaucracy | Urban |

| KYA | Donor compliance | Outsources poles | Corridors |

| Solektra | Fast rollout | Lower specs | Villages |

| Chinese EPCs | Scale | Rigid | Highways |

| Local EPCs | Cheap | Weak docs | Wards |

| Donors | Funding | Slow | Rural |

| NGOs | Community | Small | Clinics |

| Sunlurio | Scale + compliance | Premium | 500-set flagship |

Across these ten countries, patterns repeat:

- Utilities and ministries (KPLC, REA, TANESCO, SONABEL, MEMC) dominate tenders.

- Donor-backed programs (World Bank, AfDB, AFD, BOAD) require strict IEC/CE, IP66/IK08, ISO 12944 compliance, often in French.

- Chinese EPCs win corridor/highway bundles via road contracts.

- Local EPCs/SMEs deliver 50–150 light lots fast, but struggle with compliance.

- Premium players (BEKA Schréder, Eiffage, VINCI) excel at donor paperwork but charge more.

The gap: Many suppliers still offer 150–170 lm/W LEDs, weak poles, and batteries that fail in 2–3 years. EPCs who submit these specs risk losing tenders or O&M headaches.

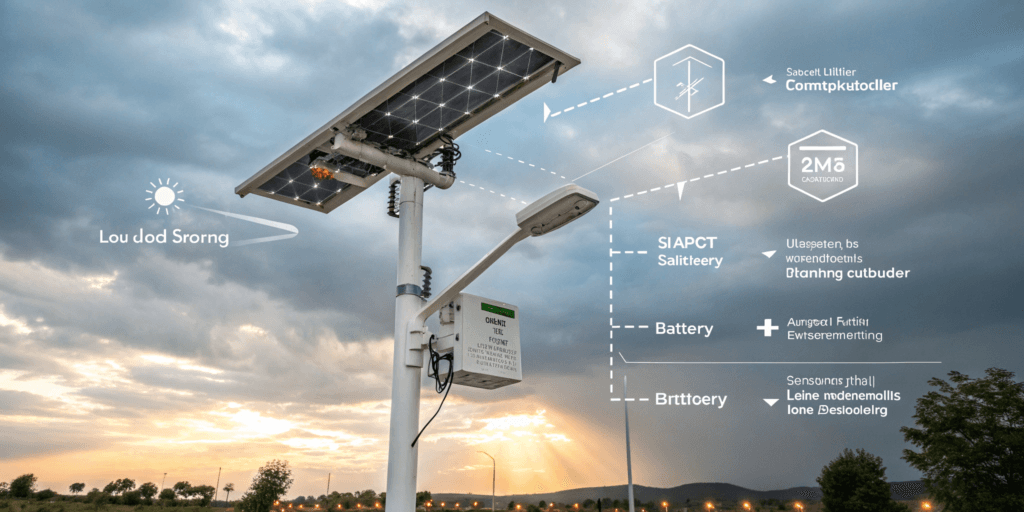

Sunlurio helps EPCs, ministries, and councils win tenders in Africa by delivering:

- High-performance LEDs: 230 lm/W, reducing cost per lumen.

- LiFePO₄ batteries: ≥6000 cycles, lasting 8–10 years.

- Hot-dip galvanized poles: ISO 12944, 720 h salt-spray tested.

- Compliance-ready docs: IEC/CE, LM-80/LM-79, IP66/IK08, French/English versions.

- Container-optimized logistics: 7 m poles, 40HQ load plans.

- After-sales: Spares kits, training, O&M support.

👉 Don’t let poor paperwork or weak hardware kill your bid. Partner with Sunlurio for compliance-ready, project-tested solar street lighting.